The majority of discussion pertaining to health care reform has, in my opinion, fostered an under appreciation for the role that age plays in determining one's stance on the subject. Perhaps this is because it is easier for the media to discuss this issue in terms of either broad ideological preferences of weak v strong government, or class based, "ability to pay v not" scenarios. Whatever the underlying reasons may be, I believe it's distracted us from the obvious reality that voters tend to advocate for - or against - those policies which they perceive to be the most personally advantageous. For voters who are currently Medicare beneficiaries - or are close enough to the age of eligibility to ascertain that the system will still be solvent at the time of their eligibility - the personally advantageous option is to oppose health care reform. The justification is simply that any new health entitlement program would be partially funded through changes to Medicare; this doesn't necessarily mean cuts to benefits, but seniors would prefer not to test the government on this one. Younger voters on the other hand, are well aware that Medicare will not exist in it's current form by the time they are eligible. They are also somewhat cognizant of the fact that rising health care costs have, over the past decade, taken the place of substantive salary increases. That being said, let's look at the age dispersion from the most recent NBC/WSJ poll:

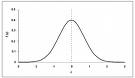

The age dispersion of the poll's respondents indicates that 50 years old is the 50th percentile; in other words, half of respondents are below 50 years old, and half are below 50 years old. While keeping the age of the poll's respondents in mind, let's move to what I consider to be the most compelling question of the survey: Would you find it acceptable to fund the current health care proposal by reducing payments to hospitals and drug makers for the services or products they provide to patients on Medicaid or Medicare? Below is a chart showing how respondent's answered that question:

The age dispersion of the poll's respondents indicates that 50 years old is the 50th percentile; in other words, half of respondents are below 50 years old, and half are below 50 years old. While keeping the age of the poll's respondents in mind, let's move to what I consider to be the most compelling question of the survey: Would you find it acceptable to fund the current health care proposal by reducing payments to hospitals and drug makers for the services or products they provide to patients on Medicaid or Medicare? Below is a chart showing how respondent's answered that question: With a ~3% margin of error for this survey, you can see that the two answers are statistically very close. My guess is that those between the ages of 18 and 49 answered with a majority "Acceptable" response, and those over 50 responded "Not Acceptable". I'd also guess that as you get closer to the 50th percentile (50 years), the rate of those responding "Not Sure" increases.

With a ~3% margin of error for this survey, you can see that the two answers are statistically very close. My guess is that those between the ages of 18 and 49 answered with a majority "Acceptable" response, and those over 50 responded "Not Acceptable". I'd also guess that as you get closer to the 50th percentile (50 years), the rate of those responding "Not Sure" increases.Now, however, let me introduce the game-changer: those in the 55+ age bracket show up to the voting booths in far greater numbers than any other age group. Furthermore, this group's voting influence increases significantly during mid-term elections (think 2010). Voters over 55 show up in heavy numbers at both Presidential elections and the mid-terms; younger voters have been known to get excited over a Presidential candidate (think Obama) and increase their turnout at that election, only to dissipate,lose interest, etc. by the time mid-terms roll around. Obviously, this has Congress worried.

Perhaps the above dynamic represents the largest flaw in President Obama's strategy of tossing the health care idea to Congress, and settling into a "hands-off" management approach. I'll reserve final judgment of that strategy until all is said and done; however, should the health reform effort fail, fault may lie with the politically powerful President who ceded the majority of the process to a mid-term fearing Congress. Sphere: Related Content